As you may know, the Secure Act put an end to the Stretch IRA. The stretch IRA is the ability to stretch the IRA distributions over the beneficiaries’ lifetime. Let us look at the new rules to see how this may impact your current situation.

Continue readingLeaving your 401k After Separation From Employment

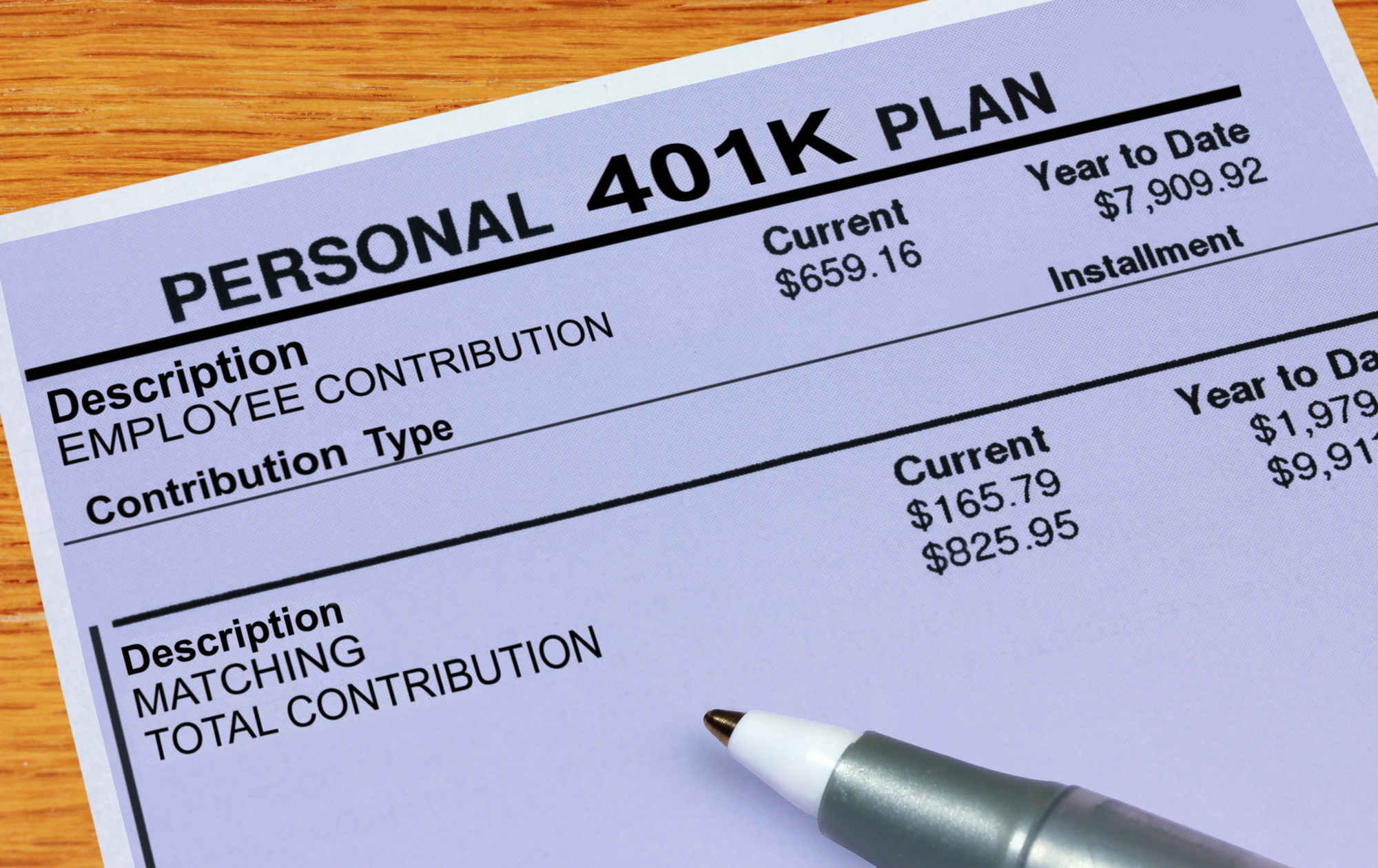

There are pros and cons to leaving your 401k plan with your previous employer that should be evaluated before any moves are made. This is not an exhaustive list, just some main points to get you thinking about things that are involved.

Continue readingROTH IRA’s – Why the Hype?

There has been a lot of talk in the media recently about ROTH IRA’s, Backdoor ROTH IRA’s, and Mega Backdoor ROTH IRA’s? The biggest reason for this is because we are in such a low tax environment. Do we know what the tax landscape will look like when we need the money? No, but we do know that now we are dealing with low rates, and we can choose to pay these low rates and deal with what we do know.

Continue readingAre you self-employed? What are your retirement plan options?

You’ve built your business up and now you are at the point of having excess income and you think you should start saving some for retirement.

Continue readingIRA vs. ROTH IRA

Whether you are preparing your income taxes yourself or you have hired someone to do them for you, you will most likely be seeing the question asking if you contributed to an IRA or ROTH IRA for the previous tax year. By the way, you have until April 15th to make that contribution for the previous year-just make sure it is reported in your filing!

IRA’s

- Tax Deferred—you get a tax break on the money you contribute. You will pay tax on all distributions. If you withdraw before age 59.5, there is a 10% penalty on top of the taxes unless you qualify for an exception.

- Tax-Deductible Eligibility—If you and your spouse are not covered by a retirement plan at work, then your contributions are tax deductible. If one or both of you are covered by a work retirement plan, then there are further income tests to determine if the contribution will be tax deductible.

- Contribution Limits—For 2020 and 2021, the higher of your Earned Income or $6000 ($7000 if age 50+).

- Required Minimum Distributions—you are required to start taking money out of your IRA’s every year starting at age 72. The government gave you a tax break all of these years, now they need some revenue.

ROTH IRA’s

- After tax contributions—you contribute after tax money. As long as the ROTH IRA has been open for 5 years and you are 59.5, then your distributions are TAX FREE.

- Contribution Limits—the same for IRA’s above ($6K, $7K for age 50+).

- Contribution Eligibility—there are income limits to be able to contribute to a ROTH IRA

- No Required Minimum Distributions while the owner is alive, however, a beneficiary will be required to take minimum distributions but no tax will be due.

Let’s say you aren’t eligible to contribute to an IRA or a ROTH IRA, but you really like the idea of this ROTH IRA—because who doesn’t like TAX FREE MONEY?! If you have an IRA account you can do what is called a ROTH Conversion. A ROTH Conversion is the process of converting your IRA account to a ROTH and paying the taxes now. There are some other things to consider when doing this, so you should consult a professional.

Financial Journey LLC is a registered investment advisor offering advisory services in the state of Virginia and in other jurisdictions where exempted. Information provided is for educational purposes only and not, in any way, to be considered investment or tax advice.