Recently Treasury I-Bonds have received a lot of press. It makes sense in this low interest rate environment why they would be talked about-a government bond paying an annualized rate of 7.12%!

Continue readingWhat Happens if you Die without a Will?

Many of our clients don’t know what probate is, and that isn’t necessarily a bad thing. If you’ve never had a loved one die, you may never have experienced it. Probate is the legal process by which a will is validated. If there’s no will, it’s the legal process of settling a person’s affairs. In other words, if you didn’t write your own will, the state has one for you.

Continue readingHSAs as a Supplement to Retirement Savings

Health Savings Accounts (HSA’s) are not a new thing, but many people still are not that familiar with how they work. Flex Spending Accounts (FSA’s) are still around and there is still confusion between the two because they do have similarities. One of the biggest differences between the two types of accounts is that the HSA does not have to be used by a specific time. (With FSA’s you have specific time to use the money for medical expenses or you lose it).

Continue readingLeaving your 401k After Separation From Employment

There are pros and cons to leaving your 401k plan with your previous employer that should be evaluated before any moves are made. This is not an exhaustive list, just some main points to get you thinking about things that are involved.

Continue readingROTH IRA’s – Why the Hype?

There has been a lot of talk in the media recently about ROTH IRA’s, Backdoor ROTH IRA’s, and Mega Backdoor ROTH IRA’s? The biggest reason for this is because we are in such a low tax environment. Do we know what the tax landscape will look like when we need the money? No, but we do know that now we are dealing with low rates, and we can choose to pay these low rates and deal with what we do know.

Continue readingHealth Savings Account

A Health Savings Account (HSA) is an account that you can fund for medical expenses when you are enrolled in a high deductible health plan. This can be a great tool to pay for medical expenses tax free. A high deductible health plan has certain parameters to meet in order to qualify. If you are a healthy individual and rarely go to the doctor, this is a great savings tool for you.

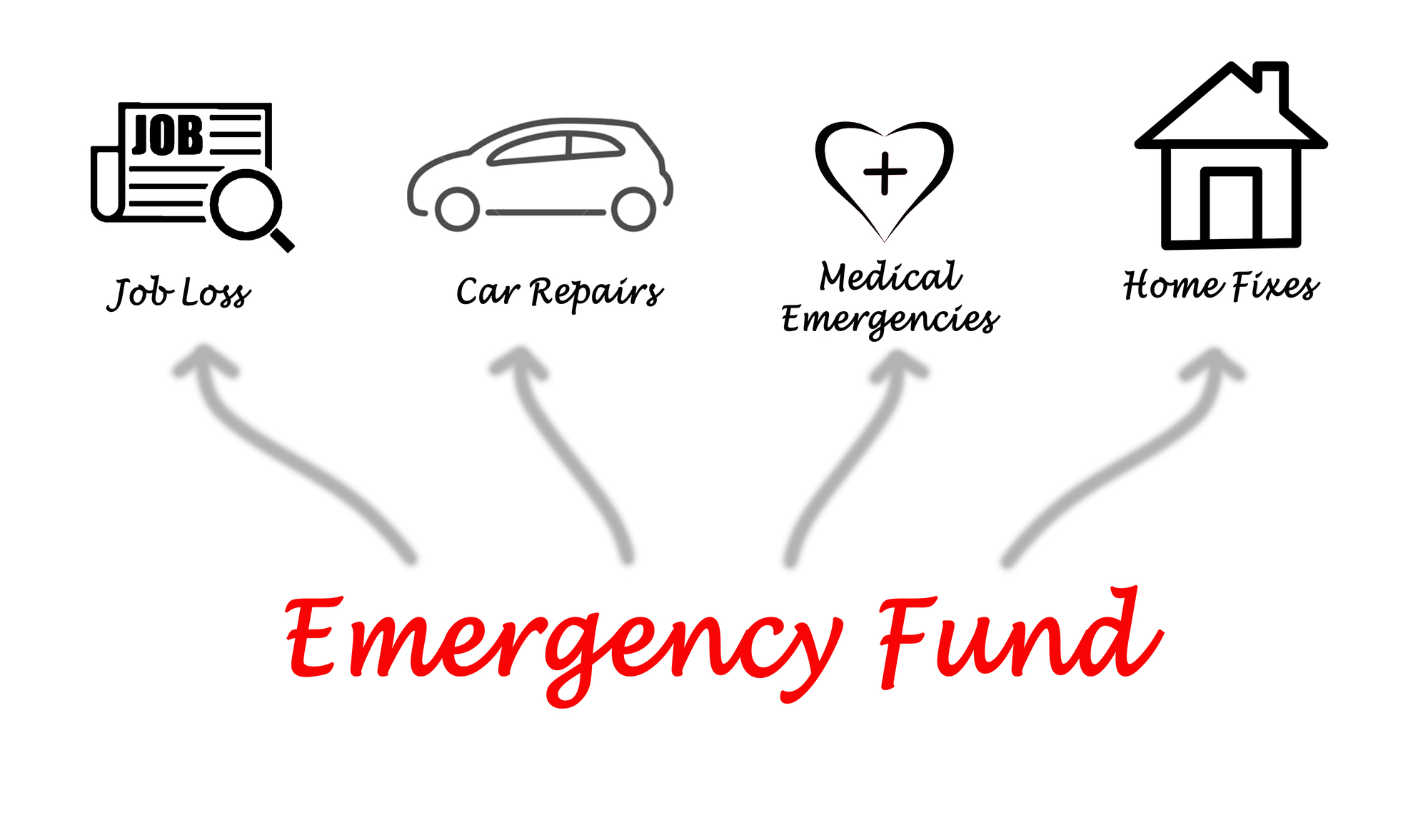

Continue readingEmergency Fund – How Much?

Your Emergency Fund is your savings account that has no risk to principal—so it’s in cash. The purpose of your Emergency Fund is just as it sounds-for emergencies! Emergencies can be losing a job, unexpected home repair, illness, major car repair or your pet needs surgery—really anything that is completely unexpected.

Continue reading529 Plan For College Savings

If you have kids and saving for their college is on your mind, I am sure you have heard of a 529 College Savings Plan. A 529 plan (named from the Internal Revenue Code Section 529) can be a great tool to help you save for those college years. Do you know there are 2 types of 529 plans? The 2 different types are a Pre-paid plan and a Savings Plan.

Continue reading