According to the Forbes article, “The Four Things Women Want (in Financial Services),” women want the following: – more confidence with their finances, more convenience, better communication, and better collaboration.

Continue readingThe FIRE Movement – Or choices?

Let’s start with what FIRE stands for—Financial Independence, Retire Early. Isn’t this what everyone wants? I have a theory about how this movement started. There has been a lot of research in the financial planning space and trying to figure out how much you need in investment assets and how much you can take out over the course of your retirement (safe withdrawal rate) without running out of money.

Continue readingHow to Choose a Self-Employed Retirement Plan

The first step to deciding which retirement plan to choose for your self-employment income is figuring out the amount that you think you will be able to contribute. From that point, then you can choose which vehicle may work best for you.

Continue readingWhat is Tax Planning?

Tax planning is considering your whole situation and making any necessary changes or decisions before the tax year is complete. Think of it as forward looking. When you prepare your tax return, you are looking backwards at things that have already happened and figuring out any credits or deductions that you can take based on things you cannot change.

Continue readingEstate Plans: Not Just for the Wealthy

There are several misconceptions about estate planning. For instance, many people think you need to be ultra-wealthy to create one, or that they are only relevant to parents with young kids and senior citizens.

Continue readingFinancial Plan vs. Estate Plan-What’s the Difference?

A Financial Plan is a look at your current financial health and a map to help you reach your goals. It looks at income, expenses, assets, and debt. If you keep all four of these in balance, you should have enough money to invest in a way that matches your risk tolerance. A well-designed plan puts you on track to reach your goals.

Continue readingHSAs as a Supplement to Retirement Savings

Health Savings Accounts (HSA’s) are not a new thing, but many people still are not that familiar with how they work. Flex Spending Accounts (FSA’s) are still around and there is still confusion between the two because they do have similarities. One of the biggest differences between the two types of accounts is that the HSA does not have to be used by a specific time. (With FSA’s you have specific time to use the money for medical expenses or you lose it).

Continue readingROTH IRA’s – Why the Hype?

There has been a lot of talk in the media recently about ROTH IRA’s, Backdoor ROTH IRA’s, and Mega Backdoor ROTH IRA’s? The biggest reason for this is because we are in such a low tax environment. Do we know what the tax landscape will look like when we need the money? No, but we do know that now we are dealing with low rates, and we can choose to pay these low rates and deal with what we do know.

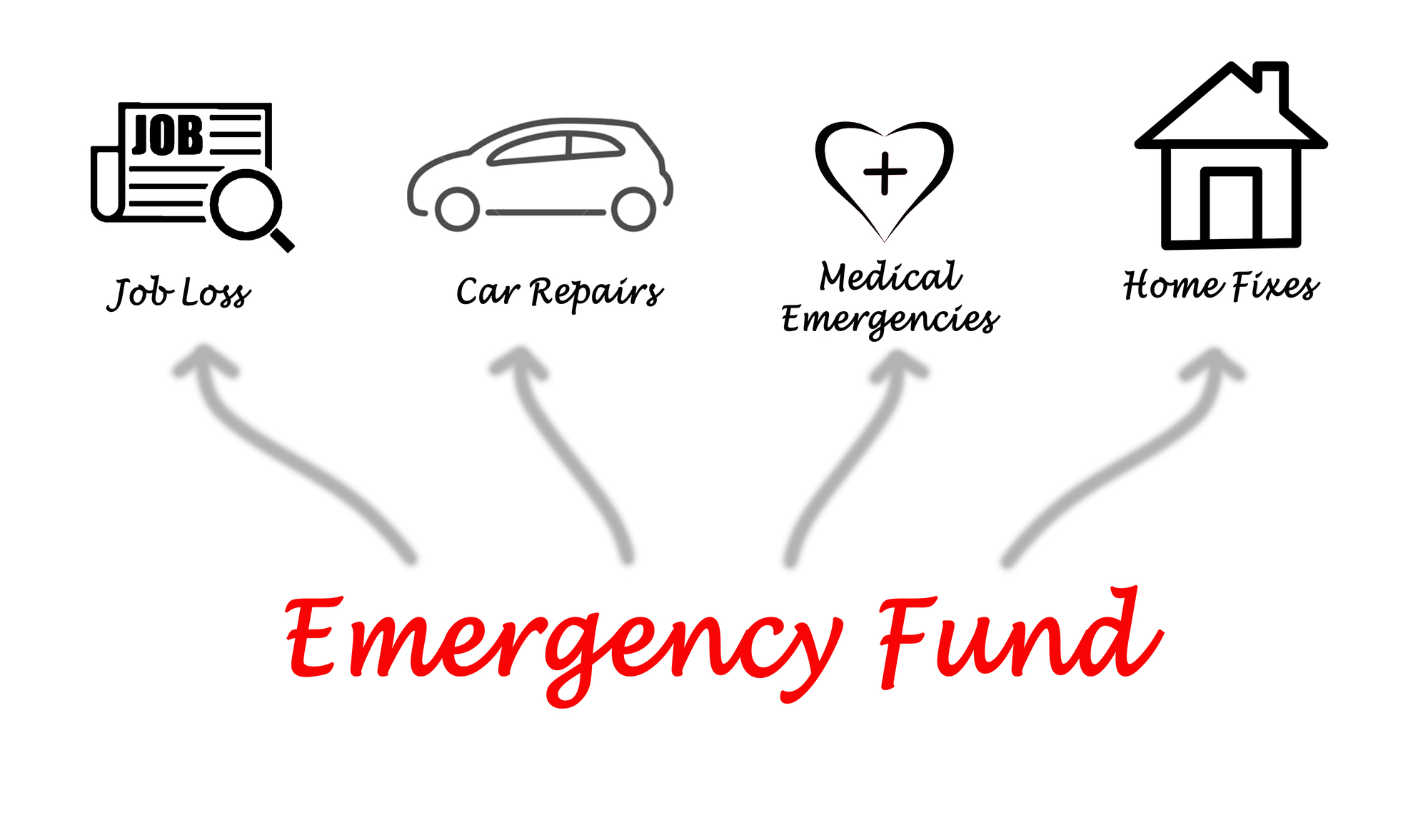

Continue readingEmergency Fund – How Much?

Your Emergency Fund is your savings account that has no risk to principal—so it’s in cash. The purpose of your Emergency Fund is just as it sounds-for emergencies! Emergencies can be losing a job, unexpected home repair, illness, major car repair or your pet needs surgery—really anything that is completely unexpected.

Continue reading529 Plan For College Savings

If you have kids and saving for their college is on your mind, I am sure you have heard of a 529 College Savings Plan. A 529 plan (named from the Internal Revenue Code Section 529) can be a great tool to help you save for those college years. Do you know there are 2 types of 529 plans? The 2 different types are a Pre-paid plan and a Savings Plan.

Continue reading